How Offshore Trusts Can Shield Your Wealth from Divorce Settlements

How Offshore Trusts Can Shield Your Wealth from Divorce Settlements

Blog Article

The Essential Overview to Establishing an Offshore Depend On for Estate Planning and Tax Performance

If you're thinking about ways to shield your assets and plan for the future, establishing up an overseas depend on might be a wise move. Guiding with the complexities of offshore trust funds calls for cautious preparation and knowledge.

Recognizing Offshore Trusts: An Overview

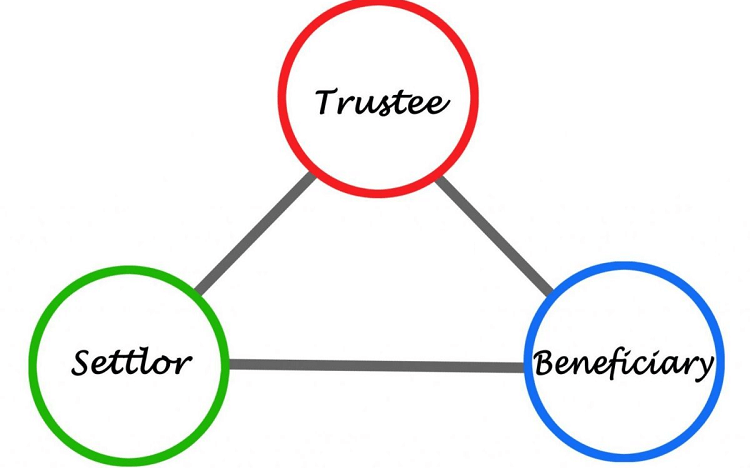

When you're exploring estate planning choices, recognizing overseas depends on can be considerable. An overseas count on is a lawful setup where you position your assets in a depend on taken care of by a trustee in a foreign territory. This configuration can assist you secure your wide range and assure it's dispersed according to your dreams.

You'll normally pick a jurisdiction understood for beneficial trust laws and privacy defenses. It is necessary to grasp the difference between a residential trust and an offshore count on, as the latter commonly uses one-of-a-kind advantages, such as property protection versus creditors and potential tax benefits.

Prior to diving in, you should take into consideration the legal and tax ramifications both in your home country and the territory where the trust is established. Dealing with a certified lawyer or monetary advisor is crucial to navigate this complicated landscape efficiently. Recognizing these fundamental components will encourage you to make educated choices concerning your estate planning method.

Key Advantages of Developing an Offshore Count On

Developing an overseas trust uses numerous compelling advantages that can improve your estate preparation strategy. It provides asset protection from creditors and legal insurance claims, ensuring your wealth stays safe and secure. By positioning your assets in an overseas depend on, you can likewise delight in prospective tax benefits, as some territories offer positive tax obligation treatment for counts on. This can aid you decrease your tax obligation obligations while lawfully protecting your wide range.

In addition, overseas depends on use boosted privacy. Unlike domestic trusts, which might undergo public analysis, offshore counts on can help keep confidentiality regarding your financial events. This personal privacy includes your beneficiaries, protecting their inheritance from undesirable interest.

Additionally, offshore trusts can facilitate smoother wide range transfer across generations, circumventing probate procedures that may postpone possession circulation. Generally, establishing an overseas count on is a tactical relocation to guard your possessions, optimize tax obligation efficiency, and assure your estate planning objectives are satisfied effectively.

Sorts Of Offshore Trusts and Their Purposes

Offshore counts on come in different forms, each created to serve details functions within your estate planning approach. One typical kind is the discretionary trust, where the trustee has adaptability in distributing properties among recipients. This can help secure your estate from creditors and give financial backing to your liked ones based upon their needs.

One more choice is the set count on, where beneficiaries obtain predetermined shares of the count on properties. This framework is optimal for ensuring equal distribution among beneficiaries.

You may additionally consider a spendthrift count on, which safeguards possessions from recipients that might not take care of money wisely. This enables you to supply for their demands while shielding the estate.

Lastly, there's the charitable depend on, which profits a philanthropic company while possibly giving tax advantages for you. Each type of offshore trust can help accomplish various objectives, so it is critical to select one that straightens with your estate planning goals.

Legal Factors To Consider for Setting Up an Offshore Trust

Before you established an overseas trust fund, it's important to comprehend the legal considerations involved. You'll require to ensure compliance with both your home nation's regulations and the laws of the overseas jurisdiction you choose. Many nations need you to report overseas depends on, so be gotten ready for prospective tax ramifications.

Next, consider the trust fund's framework. Different sorts of depends on may offer differing levels of asset defense and tax benefits, relying on regional regulations. You must likewise make clear the functions of the trustee and beneficiaries, as these partnerships can considerably affect exactly how the count on runs.

Furthermore, understand anti-money laundering regulations and other regulations that might use. Consulting with attorneys experienced in offshore counts on is vital to browse these complexities successfully. Complying with these lawful guidelines can aid you prevent challenges and ensure your overseas depend on serves its objective efficiently.

Actions to Establish an Offshore Depend On

With a solid understanding of the legal factors to consider, you can now take actions to establish an overseas trust. Initially, select a reputable territory that straightens with your goals and uses solid privacy securities. Next, choose a reliable trustee who comprehends the intricacies of taking care of overseas counts on. You'll intend to review your details needs and goals with them.

After that, compose the count on act, detailing the terms, beneficiaries, and the possessions you plan to transfer. Ensure to consult lawful and economic experts to assure conformity with neighborhood laws. As soon as the act is wrapped up, money the trust fund by moving possessions, which may include money, property, or investments.

Finally, keep accurate records and monitor the count on's efficiency routinely. This helps you establish that it's working as meant and lines up with your estate intending goals. Complying with these steps will put you on the course to producing an efficient overseas trust.

Tax Obligation Ramifications of Offshore Counts On

While considering an overseas trust, it's vital to comprehend the tax obligation effects that can develop. Depending on the trust fund's structure, you may encounter income tax obligation on circulations or gains generated within the depend on.

Additionally, if the depend on is regarded a grantor count on, you'll be liable for reporting its earnings on your individual tax obligation return. It's essential to compare revocable and unalterable trusts, as their tax obligation therapies differ significantly.

While overseas counts on can supply asset defense and privacy advantages, they won't necessarily shield you from U.S. tax obligations (Offshore Trusts). Consulting a tax specialist skilled in global legislations is necessary to navigate these intricacies and guarantee compliance while making best use of the benefits of your overseas trust fund

Common Misconceptions About Offshore Counts On

When it involves overseas depends on, many individuals think they're just for the well-off or that they're about his prohibited. In truth, offshore trusts can be a lawful and reliable estate planning tool for any individual seeking to secure their possessions. Let's improve these common misunderstandings and explore what offshore trust funds can actually use.

Legality and Compliance Issues

Lots of people wrongly believe that offshore trusts are inherently illegal or solely a device for tax obligation evasion. Actually, these trust funds can be perfectly legal when set up and kept in compliance with the legislations of both your home country and the territory where the count on is developed. Recognizing your responsibilities is vital. You'll require to reveal the presence of an offshore depend tax obligation authorities and ensure that you're sticking to reporting demands. Mismanagement or read review ignorance of these guidelines can result in fines, but when done appropriately, offshore trust funds provide legitimate advantages, including property security and estate planning advantages. Offshore Trusts. It is necessary to deal with well-informed professionals to browse the complexities and stay clear of misconceptions.

Wealthy People Only Misconception

Offshore trusts aren't simply for the ultra-wealthy; they can be beneficial devices for any person wanting to safeguard their properties and prepare their estate. Lots of individuals mistakenly think that just the abundant can gain from these counts on, but that's simply not true. Individuals with modest wealth can also utilize offshore depend guard their properties from financial institutions, suits, and prospective tax obligations. These counts on can provide higher personal privacy and versatility in estate preparation. By dispelling the myth that offshore counts on are exclusively for the elite, you open up brand-new opportunities for safeguarding your economic future. Don't let misunderstandings hold you back; discover how an offshore count on may be a smart choice for your estate intending demands.

Regularly Asked Concerns

Just how much Does It Price to Set up an Offshore Trust?

Establishing an offshore trust can set you back anywhere from a few thousand to tens of hundreds of bucks (Offshore Trusts). You'll require to take into consideration lawful fees, management costs, and any kind of continuous maintenance expenditures that may emerge

Can I Handle My Offshore Trust From My Home Nation?

Yes, you can manage your overseas trust fund from your home nation. It's important to comprehend the lawful ramifications and tax obligation guidelines entailed. Consulting with a lawful expert can assist ensure you're compliant and educated.

What Possessions Can Be Placed in an Offshore Trust Fund?

Are Offshore Trusts Legal for Every Person?

Yes, overseas trusts are legal for everyone, but their legitimacy differs by territory. You'll require to understand your neighborhood regulations and laws to guarantee compliance, so it's important to get in touch with a legal specialist before continuing.

How Do I Select a Trustee for My Offshore Depend On?

Picking a trustee for your overseas trust fund involves examining their experience, reliability, and understanding of your details demands. You must likewise consider their fees and Click This Link just how well you communicate with them to guarantee an effective partnership.

Report this page